publications

* means Equal Contribution

-

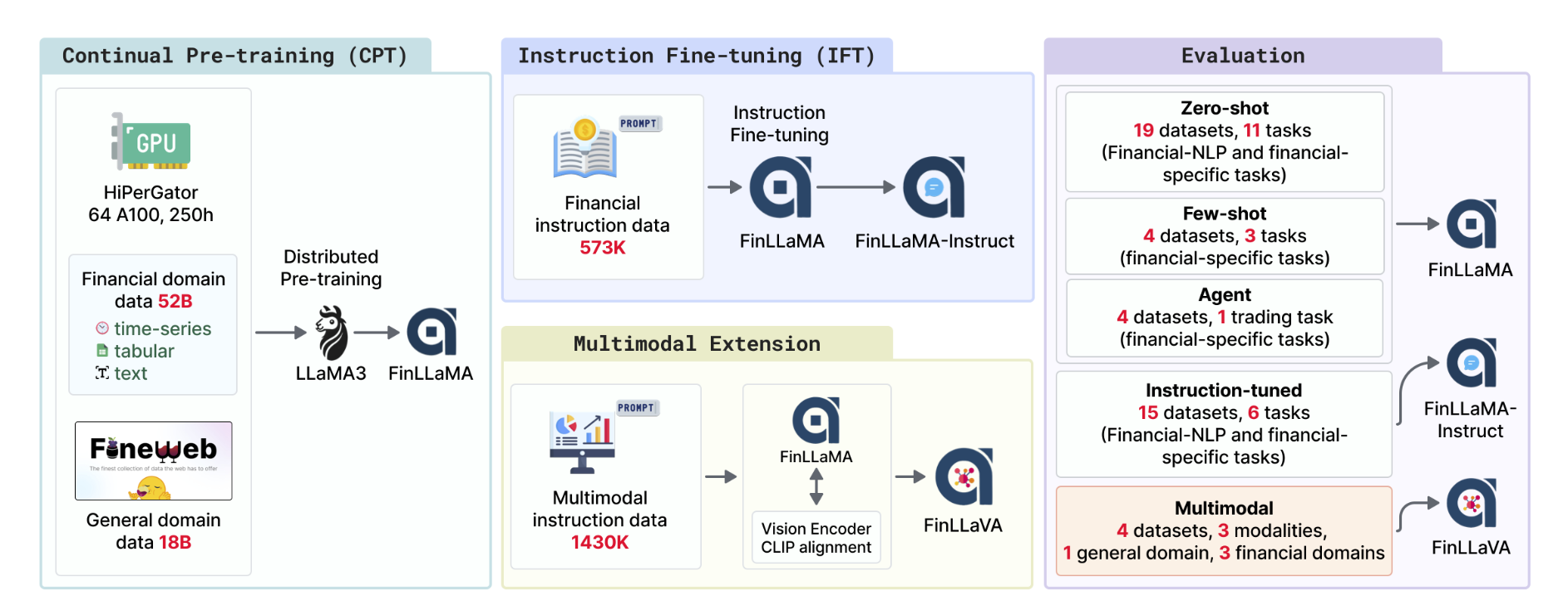

Open-FinLLMs: Open Multimodal Large Language Models for Financial Applications 2024Jimin Huang, Mengxi Xiao, Dong Li, Zihao Jiang, Yuzhe Yang, Yifei Zhang, and 38 more authorsarXiv preprint,First open-source financial multimodal LLM: FinLLaVA-8B

Open-FinLLMs: Open Multimodal Large Language Models for Financial Applications 2024Jimin Huang, Mengxi Xiao, Dong Li, Zihao Jiang, Yuzhe Yang, Yifei Zhang, and 38 more authorsarXiv preprint,First open-source financial multimodal LLM: FinLLaVA-8BLarge language models (LLMs) have advanced financial applications, yet they often lack sufficient financial knowledge and struggle with tasks involving multi-modal inputs like tables and time series data. To address these limitations, we introduce Open-FinLLMs, a series of Financial LLMs. We begin with FinLLaMA, pre-trained on a 52 billion token financial corpus, incorporating text, tables, and time-series data to embed comprehensive financial knowledge. FinLLaMA is then instruction fine-tuned with 573K financial instructions, resulting in FinLLaMA-instruct, which enhances task performance. Finally, we present FinLLaVA, a multimodal LLM trained with 1.43M image-text instructions to handle complex financial data types. Extensive evaluations demonstrate FinLLaMA’s superior performance over LLaMA3-8B, LLaMA3.1-8B, and BloombergGPT in both zero-shot and few-shot settings across 19 and 4 datasets, respectively. FinLLaMA-instruct outperforms GPT-4 and other Financial LLMs on 15 datasets. FinLLaVA excels in understanding tables and charts across 4 multimodal tasks. Additionally, FinLLaMA achieves impressive Sharpe Ratios in trading simulations, highlighting its robust financial application capabilities. We will continually maintain and improve our models and benchmarks to support ongoing innovation in academia and industry.

-

Do investors’ actions speak louder than words? 2024Honghai Yu, Zhuo Chen, Yunmiao Zhang, Haining Wang, and Yifei ZhangAn extended version of undergraduate thesis, accepted by the 21st Annual Conference on Financial Engineering and Risk Management

Do investors’ actions speak louder than words? 2024Honghai Yu, Zhuo Chen, Yunmiao Zhang, Haining Wang, and Yifei ZhangAn extended version of undergraduate thesis, accepted by the 21st Annual Conference on Financial Engineering and Risk ManagementA large body of literature has examined whether posts on social media propagate noise or information. In this paper, we propose that both coexist on Chinese social media platforms but can be distinguished by posters’ trading behavior. Individuals may post articles on social media that do not reflect their true opinions, often for impression management purposes, resulting in inconsistency between their words and subsequent actions. Additionally, observing a poster’s trading behavior prior to posting can help assess the reliability of their expressed views.

-

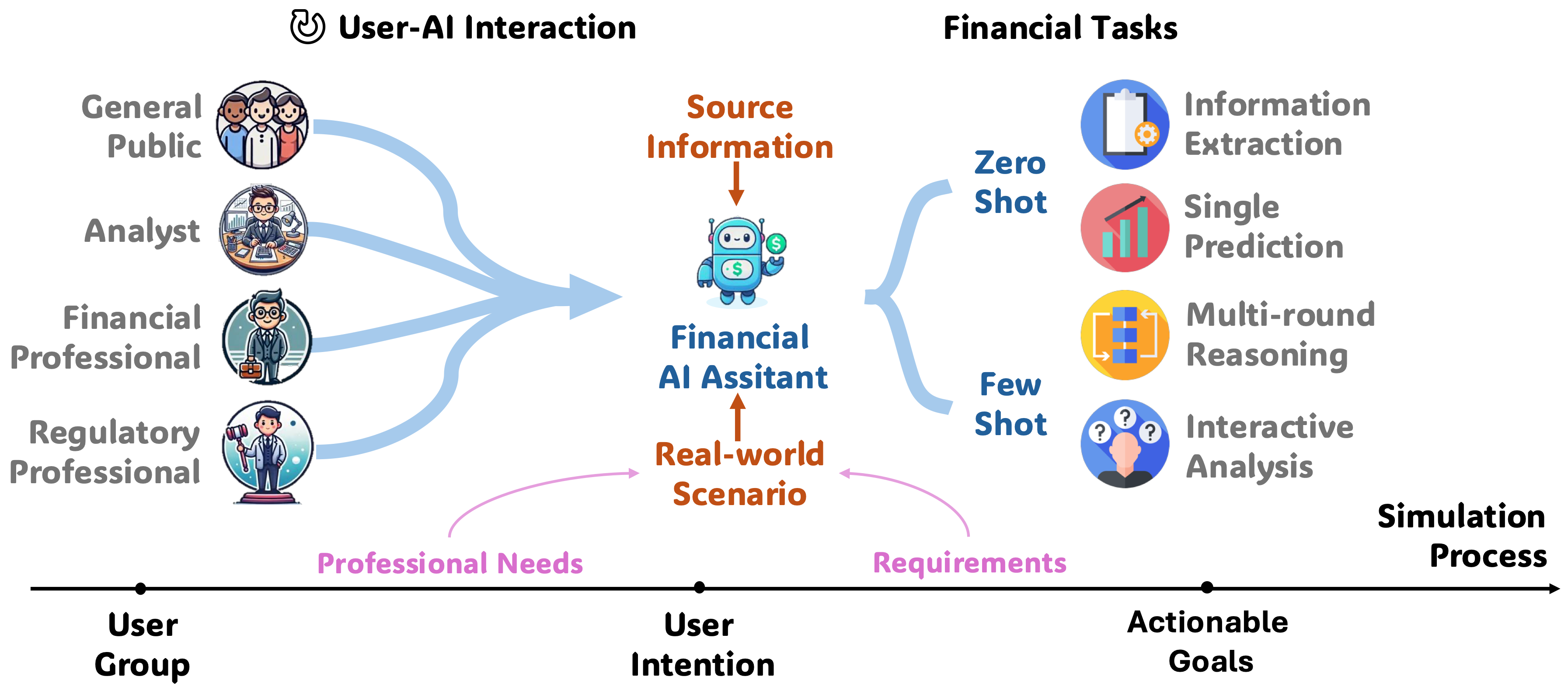

UCFE: A User-Centric Financial Expertise Benchmark for Large Language ModelsYuzhe Yang*, Yifei Zhang*, Yan Hu*, Yilin Guo, Ruoli Gan, Yueru He, and 7 more authorsNAACL Findings 2025,A User-Centric framework designed to evaluate LLMs’ ability to handle complex financial tasks

UCFE: A User-Centric Financial Expertise Benchmark for Large Language ModelsYuzhe Yang*, Yifei Zhang*, Yan Hu*, Yilin Guo, Ruoli Gan, Yueru He, and 7 more authorsNAACL Findings 2025,A User-Centric framework designed to evaluate LLMs’ ability to handle complex financial tasksThis paper introduces the UCFE: User-Centric Financial Expertise benchmark, an innovative framework designed to evaluate the ability of large language models (LLMs) to handle complex real-world financial tasks. UCFE benchmark adopts a hybrid approach that combines human expert evaluations with dynamic, taskspecific interactions to simulate the complexities of evolving financial scenarios. Firstly, we conducted a user study involving 804 participants, collecting their feedback on financial tasks. Secondly, based on this feedback, we created our dataset that encompasses a wide range of user intents and interactions. This dataset serves as the foundation for benchmarking 12 LLM services using the LLM-as-Judge methodology. Our results show a significant alignment between benchmark scores and human preferences, with a Pearson correlation coefficient of 0.78, confirming the effectiveness of the UCFE dataset and our evaluation approach. UCFE benchmark not only reveals the potential of LLMs in the financial sector but also provides a robust framework for assessing their performance and user satisfaction.The benchmark dataset and evaluation code are available.

-

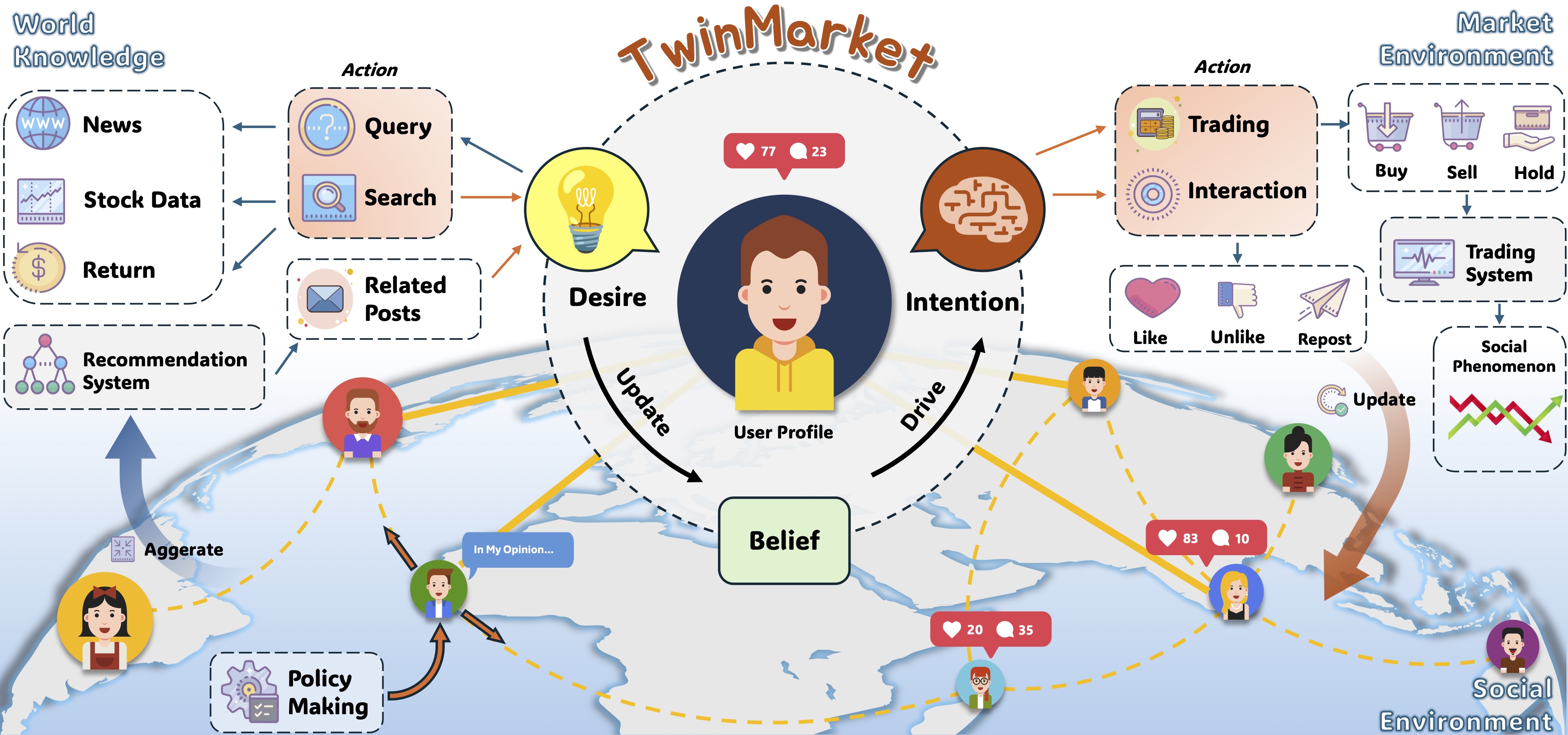

TwinMarket: A Scalable Behavioral and SocialSimulation for Financial MarketsYuzhe Yang*, Yifei Zhang*, Minghao Wu*, Kaidi Zhang, Yunmiao Zhang, Honghai Yu, and 2 more authorsNeurIPS 2025 & Best Paper Award in Financial AI @ ICLR 2025,A multi-agent framework that leverages LLMs to simulate socio-economic systems

TwinMarket: A Scalable Behavioral and SocialSimulation for Financial MarketsYuzhe Yang*, Yifei Zhang*, Minghao Wu*, Kaidi Zhang, Yunmiao Zhang, Honghai Yu, and 2 more authorsNeurIPS 2025 & Best Paper Award in Financial AI @ ICLR 2025,A multi-agent framework that leverages LLMs to simulate socio-economic systemsThe study of social emergence has long been a central focus in social science. Traditional modeling approaches, such as rule-based Agent-Based Models (ABMs), struggle to capture the diversity and complexity of human behavior, particularly the irrational factors emphasized in behavioral economics. Recently, large language model (LLM) agents have gained traction as simulation tools for modeling human behavior in social science and role-playing applications. Studies suggest that LLMs can account for cognitive biases, emotional fluctuations, and other non-rational influences, enabling more realistic simulations of socio-economic dynamics. In this work, we introduce TwinMarket, a novel multi-agent framework that leverages LLMs to simulate socio-economic systems. Specifically, we examine how individual behaviors, through interactions and feedback mechanisms, give rise to collective dynamics and emergent phenomena. Through experiments in a simulated stock market environment, we demonstrate how individual actions can trigger group behaviors, leading to emergent outcomes such as financial bubbles and recessions. Our approach provides valuable insights into the complex interplay between individual decision-making and collective socio-economic patterns.

-

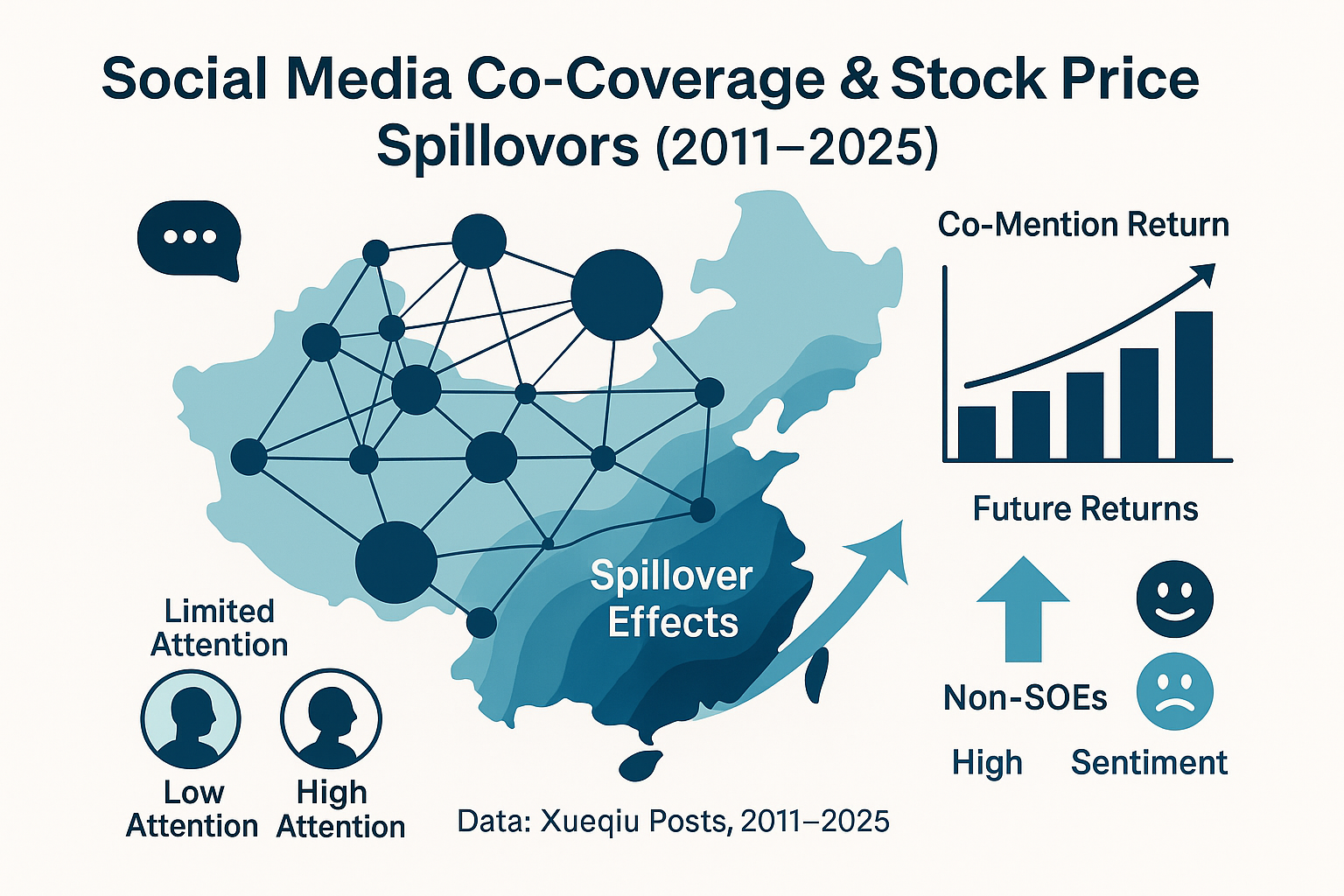

Shared Fortunes and Risks: Stock Price Spillover Effects of Corporate Ties — Evidence from the Chinese Social Media Platform "Xueqiu" 2025Honghai Yu, Yunmiao Zhang, Zhuo Chen, Chang Zeng, and Yifei ZhangOutstanding Paper, The 7th Conference of the Chinese Society of Optimization, Overall Planning, and Economic Mathematics

Shared Fortunes and Risks: Stock Price Spillover Effects of Corporate Ties — Evidence from the Chinese Social Media Platform "Xueqiu" 2025Honghai Yu, Yunmiao Zhang, Zhuo Chen, Chang Zeng, and Yifei ZhangOutstanding Paper, The 7th Conference of the Chinese Society of Optimization, Overall Planning, and Economic MathematicsBased on data from Xueqiu platform spanning 2011-2025, this study constructs social media networks among listed companies and calculates co-mention momentum indicators (CR) to examine momentum spillover effects embedded in social media associations. We find that social media co-mention return indicators have significant cross-sectional explanatory power for future stock returns, remaining robust after controlling for multiple factors. Mechanism analysis based on limited attention theory reveals that this effect is more pronounced among stocks with lower investor attention, and shows stronger predictive performance for non-state-owned enterprises and during periods of high investor sentiment. This paper reveals the unique value of social media co-coverage and provides insights into the role of alternative data in asset pricing mechanisms.

-

R&D-Agent: An LLM-Agent Framework Towards Autonomous Data Science 2025Xu Yang, Xiao Yang, Shikai Fang, Yifei Zhang, Jian Wang, Bowen Xian, and 10 more authorsarXiv preprint,An LLM-Agent framework towards autonomous data science

R&D-Agent: An LLM-Agent Framework Towards Autonomous Data Science 2025Xu Yang, Xiao Yang, Shikai Fang, Yifei Zhang, Jian Wang, Bowen Xian, and 10 more authorsarXiv preprint,An LLM-Agent framework towards autonomous data scienceRecent advances in AI and ML have transformed data science, yet increasing complexity and expertise requirements continue to hinder progress. Although crowd-sourcing platforms alleviate some challenges, high-level machine learning engineering (MLE) tasks remain labor-intensive and iterative. We introduce R&D Agent, a comprehensive, decoupled, and extensible framework that formalizes the MLE process. R&D-Agent defines the MLE workflow into two phases and six components, turning agent design for MLE from ad-hoc craftsmanship into a principled, testable process. Although several existing agents report promising gains on their chosen components, they can mostly be summarized as a partial optimization from our framework’s simple baseline. Inspired by human experts, we designed efficient and effective agents within this framework that achieve state of-the-art performance. Evaluated on MLE-Bench, the agent built on R&D-Agent ranks as the top-performing machine learning engineering agent, achieving 35.1% any medal rate, demonstrating the ability of the framework to speed up innovation and improve accuracy across a wide range of data science applications.